SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,223

- Qantas

- LT Silver

- Virgin

- Red

I have this evening made 2 bookings on Qantas Hotels. Both hotels are in China. Only the second booking generated a tax invoice.

I was told by Qantas hotels today that “some” bookings would still generate an invoice, but she could not tell me what those parameters were. Perhaps China is a starting point.I have this evening made 2 bookings on Qantas Hotels. Both hotels are in China. Only the second booking generated a tax invoice.

Crowne Plaza Chaozhou generated a tax invoice but Sheraton Shantou did not. Legally I believe both should have generated a tax invoice.I was told by Qantas hotels today that “some” bookings would still generate an invoice, but she could not tell me what those parameters were. Perhaps China is a starting point.

Would you mind sharing which hotel instigated the auto tax invoice.

AFF Supporters can remove this and all advertisements

Didn’t you hear? Qantas is above the law and plays by their own rules. It’s called QFF.I have contacted the ACCC and Consumer Protection who both said under the law Qantas Hotels is required to issue the tax invoice.

To play devils advocate, if Qantas Hotels is booking an overseas hotel, and doesn’t explicitly charge a service fee, is it required to produce a tax invoice?

As the service provided in Australia is free of charge and the service (hotel stay) is entirely consumed overseas, they are not liable for GST and as such do they only need to supply a receipt of payment?

That doesn't explain my experience documented at post #21. I expect that it is just another example of cough Qantas IT.It's possible they've moved the entity overseas and now transact from another region?

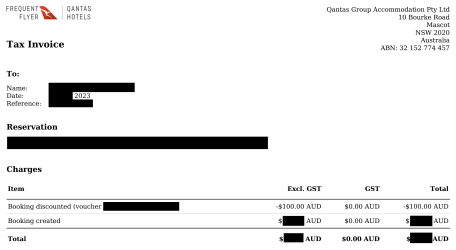

Qantas Group Accommodation, a wholly owned subsidiary of the Qantas Group.

ABN 32 152 774 457

Yes@SydneySwan Do the confirmation emails both have the following at the bottom?

The requirement to produce a tax invoice is not dependent on whether GST is charged, remember some services are GST free but still an invoice is required showing what GST (if any) is charged. The fact it specifically mentions 'if any' on the ATO website makes this clear.To play devils advocate, if Qantas Hotels is booking an overseas hotel, and doesn’t explicitly charge a service fee, is it required to produce a tax invoice?

As the service provided in Australia is free of charge and the service (hotel stay) is entirely consumed overseas, they are not liable for GST and as such do they only need to supply a receipt of payment?

I don’t know the answer but that could be one interpretation.

For Australian prepaid accommodation I would have though they definitely do have to provide a tax invoice.

Yep, as mentioned earlier it appears to be an IT snafu. I’ve always received tax invoices in the past for local and OS QF Hotel bookings - as you’d expect.The requirement to produce a tax invoice is not dependent on whether GST is charged, remember some services are GST free but still an invoice is required showing what GST (if any) is charged. The fact it specifically mentions 'if any' on the ATO website makes this clear.

A typical bureaucratic response. I suggest you send it to your local member or directly, to the Treasurer Jim Chalmers, and ask why the ATO expects the taxpayer to go to so much effort when the ATO requires the tax invoice and the supplier refuses to supply one. Perhaps suggest that this is yet another example of QF considering itself above the law or merely being difficult because the consumer has no power. Copy it to Venessa Hudson and see if they take any notice.