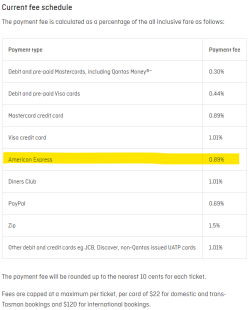

Per the table provided, they have the highest fee amongst charge cards that I'm aware of.

These days Amex is more often a credit card 'rather than a charge card, my current Amex is a rewards credit card. if you look at the table Diners (which is also a charge card has a higher fee).

Even companies that used to issue staff with the old green Amex charge cards, have in many cases moved to the credit version. Although other businesses prefer to keep the charge card.

you do have to use their portal to take advantage of the annual Qantas travel credit

Which is why I use it precisely once per year.

It's good to see that more retailers are accepting AmEx cards. And certainly for IGA that is unexpected, considering in Canada, many IGA stores won't accept AmEx.

Not sure why IGA acceptance is unexpected, I've been able to use amex at the two IGAs i frequent most often fee free since 1997! Though since they all have different owners maybe some were late t the party?

The supermarkets and large retailers have the bargaining power to negotiate really low fees compared with smaller businesses, so small they can easily absorb and not penalize customers.

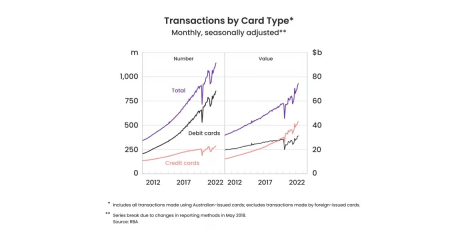

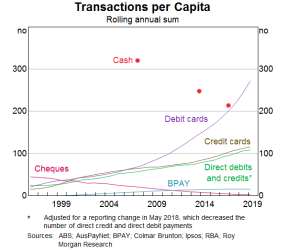

For those who were using credit cards in the 90s (seems plenty here were) you might be interested to see the somewhat of an exclusive club you were a part of.

A shame that chart doesnt separate out charge cards (which had to be paid in full each month so different from credit cards).

In 1997 when I got my first credit and charge cards it was a personal visa credit card (that had Ansett rewards) and two corporate charge cards (a diners that earned Ansett points, and an Amex that earned Qantas points).

Although the charge cards were work provided to cover work expenses like taxis to client sites, back then it was permitted to also use for personal use, provided you paid off all personal use each month. I was probably doing 50% of purchased on charge/credit, 25% Eftpos and 25% cash.

Diners used to have higher points earn than Amex so was my favoured and I used personal Visa card if Diners wasnt accepted. I had earned a heap of Ansett points after needing to do minor renovations (floorboards, air con) and furnishing my first home and redeemed the *A OWA equivalent in J back in 2001 a couple of week before the Ansett collapse. But even though none of the flights were on Ansett, it was not honoured as it hadn't been ticketed, back then it was those carbon tickets (1 page for each leg) and used to take weeks to receive. will never forgive Air NZ, they will never earn a personal $ from me.

Had I preferenced Amex over Diners during 97-01 (and got a QFF rather than Ansett visa), I would have had approx 25% fewer QFF points, but not lost out.

After Ansert collapse I switched to cards that earn bank rewards points for a while, until eventually coming back to Qantas earning cards when I was able to qualify for the black/platinum ones and was flying a lot of QF SYD-MEL for work.

These days most corporate issued charge cards exclude points earn for the individual, so better to pay on your own card and then seek reimbursement where that is an option. Obviously if you own your own business then you can benefit from QBR.

I've always minimised my cash usage and maximised points earning card usage. I have not taken any AUD cash out since 2019 and even then cash probably accounted for less than 3% of my purchases. Now it would be less than 1%, as sometimes Im gifted birthday cash.

I try not to spend anything if its not earning me points.