Thanks mate. Good to know.I Believe you need to make min payment for statement before points will credit . But you can check details under points summary .

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

Recently received Marriott Luxury spend $500 get $100 and Marriott spend $250 get $50 back, but terms state only in the US, Canada and a few other locations.

Do people who’ve utilised previous similar offers noticed if the terms have always said US only? I’ve used one such Marriott one before but can’t recall if the terms stated only those locations or worldwide then.

Do people who’ve utilised previous similar offers noticed if the terms have always said US only? I’ve used one such Marriott one before but can’t recall if the terms stated only those locations or worldwide then.

That sounds good if travelling to the US, Canada and a few other locationsRecently received Marriott Luxury spend $500 get $100 and Marriott spend $250 get $50 back, but terms state only in the US, Canada and a few other locations.

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 622

- Qantas

- Gold

- Virgin

- Red

Got the Mexican Hilton offer as part of the February offers. Good use if you want to go to Cancun or Los Cabos  .

.

Typically only properties in the US would be eligible. Would be surprised if they have a worldwide offer.

Typically only properties in the US would be eligible. Would be surprised if they have a worldwide offer.

Last edited:

I know right.That sounds good if travelling to the US, Canada and a few other locations

Last time they run one such offer, I definitely used it in Canberra, so that would appear to be a worldwide one. Although that did appear on my Brilliant (did not have the gold then).Got the Mexican Hilton offer as part of the February offers. Good use if you want to go to Cancun or Los Cabos.

Typically only properties in the US would be eligible. Would be surprised if they would have a worldwide offer.

Question to all US card holders who applied using their passport or ITIN (no SSN), have you ever had issues with your credit cards after using them for a long time in Australia and not much in the US? Like for groceries, dining, bills and etc? like a couple years or more? I'm talking about banks like Chase, CapitalOne, Citi and AmEx or any other if you have a card with like US Bank or BoA.

Have you been asked to go into a branch or been questioned around why you have international spend mostly?

Have you been asked to go into a branch or been questioned around why you have international spend mostly?

I've seen some DP's on this site about approvals with first time use of ITIN however I've run into the issue of address verification with Amex trying to apply for the Amex Green with ITIN (1st time). They asked me to upload documents including a bank statement or drivers license showing my US address. I tried to preempt this by applying for a Cap 1 checking account as others had success however they wanted to verify me in branch so couldn't do it. It seems because my ITIN is not associated with any credit or banking history both banks and credit providers need address verification. My application is still sitting with Amex for another 3 weeks until I can provide a bank statement. Any other success stories of opening personal checking accounts with ITIN remotely?Citi was my first US card (No ITIN). I have had no issue with them. Used my ITIN for the first time with them as well.

HSBC Premier seems to be the easiest way to do this remotely assuming you can qualify and it’s easier to qualify now and the monthly fee for doing so is gone.

Thanks for the tips. HSBC Premier certainly seems like the easiest path to overcome the address issue. Ironically just as I finished posting about address verification I got an email saying my Amex Green was approved. To recap, I applied online using ITIN and existing account and got the dreaded message to call in to provide more information. I called in and the rep acknowledged it was my first account with ITIN so proceeded to ask for bank statement with address etc. I said I'm in the process of setting up bank account but don't have one to provide yet". She provided the link and said to upload my ITIN letter and identity document such as drivers license with US address on it. I uploaded my ITIN letter and passport (in absence of a US drivers license) and the application status page showed more information needed for the next 5 days or so. There were no more follow up calls or communication and then today I got the approved email.I had success applying for a Capital One checking account online, but I do have a SSN — albeit one I haven't used in almost a decade. Good thing about Capital One is they provide credit scores through their online banking portal.

Even though I have had a FICO since late October now I can start building credit history with ITIN and apply for Citi cards later this year. In the meantime still need the bank account for later applications so will look at HSBC and maybe try Cap 1 again.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,290

Open an hsbc account with premiere . No need for Itin .I've seen some DP's on this site about approvals with first time use of ITIN however I've run into the issue of address verification with Amex trying to apply for the Amex Green with ITIN (1st time). They asked me to upload documents including a bank statement or drivers license showing my US address. I tried to preempt this by applying for a Cap 1 checking account as others had success however they wanted to verify me in branch so couldn't do it. It seems because my ITIN is not associated with any credit or banking history both banks and credit providers need address verification. My application is still sitting with Amex for another 3 weeks until I can provide a bank statement. Any other success stories of opening personal checking accounts with ITIN remotely?

From most data points in this thread, it seems like Amex approves people even in the absence of proof of US address. Glad it eventually worked out for you.There were no more follow up calls or communication and then today I got the approved email.

- Joined

- Feb 23, 2015

- Posts

- 6,190

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

For those holding both the Aspire and Plat Charge (issued in any country) I've just made this post about making a Hilton booking through FHR and paying on the Aspire for 14X & no forex charge by swapping out your card details in the Hilton app - could be of interest to some in this thread.

Conrad Koh Samui is on my radar as it's part of FHR and covered by the Aspire $250 resort credit. On checking a few dates right now, the FHR rate is about US$100 more expensive than the direct Honors discount rate leaving no real benefit to going via FHR, but if the FHR rate comes closer in line with the direct rate in future this could be a good way to use the Aspire credit. Not sure if there are any other resorts which are part of FHR.. if anyone finds any, please let me know!

Conrad Koh Samui is on my radar as it's part of FHR and covered by the Aspire $250 resort credit. On checking a few dates right now, the FHR rate is about US$100 more expensive than the direct Honors discount rate leaving no real benefit to going via FHR, but if the FHR rate comes closer in line with the direct rate in future this could be a good way to use the Aspire credit. Not sure if there are any other resorts which are part of FHR.. if anyone finds any, please let me know!

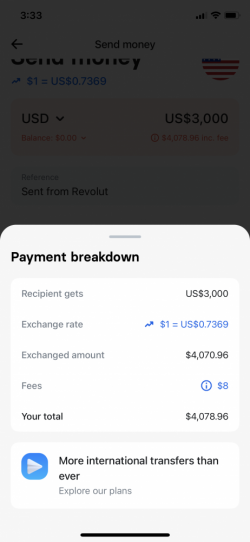

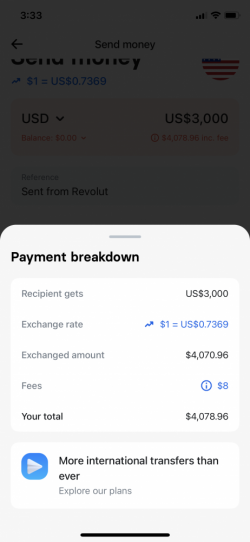

Does anyone know how to get $AUD4 flat fee international transfers with Revolut? I can't work it out and their help chat service has been absolutely useless.

Foreign currency transfers seem to be $4: https://assets.revolut.com/terms_an...Pricing Changes - External Pricing Sheet .pdf

But when I select AUD to USD, I get $AUD8.

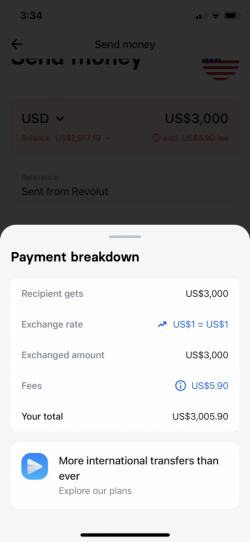

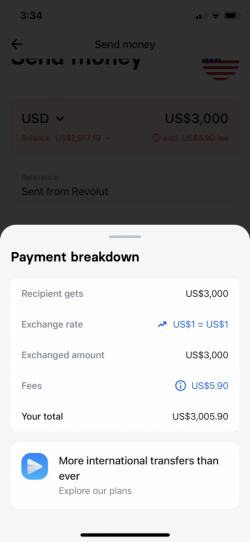

And when I select USD to USD, I get $USD5.90 ($AUD8).

Foreign currency transfers seem to be $4: https://assets.revolut.com/terms_an...Pricing Changes - External Pricing Sheet .pdf

But when I select AUD to USD, I get $AUD8.

And when I select USD to USD, I get $USD5.90 ($AUD8).

Must be old prices? Have you contacted their support?Does anyone know how to get $AUD4 flat fee international transfers with Revolut? I can't work it out and their help chat service has been absolutely useless.

Foreign currency transfers seem to be $4: https://assets.revolut.com/terms_and_conditions/pdf/[FINAL] AU - Pricing Changes - External Pricing Sheet .pdf

But when I select AUD to USD, I get $AUD8.

View attachment 274997

And when I select USD to USD, I get $USD5.90 ($AUD8).

View attachment 274998

Revolut use a % fee for international transfers.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 920

I've seen some DP's on this site about approvals with first time use of ITIN however I've run into the issue of address verification with Amex trying to apply for the Amex Green with ITIN (1st time). They asked me to upload documents including a bank statement or drivers license showing my US address. I tried to preempt this by applying for a Cap 1 checking account as others had success however they wanted to verify me in branch so couldn't do it. It seems because my ITIN is not associated with any credit or banking history both banks and credit providers need address verification. My application is still sitting with Amex for another 3 weeks until I can provide a bank statement. Any other success stories of opening personal checking accounts with ITIN remotely?

For Amex, I believe you already have a card from GT. If i were you, I would try again. You might get a different result. If they still want you to verify the address, call them and told them you already have a card with them. When I signed up for a card for p2 and Amex wanted to verify his address, the agent said she could verify it if he already had an Amex (US) card.

I would also try again with cap1. I tried to do the same thing more than once to start my US credit journey. Citi rejected my app when I first tried without SSN or ITIN but they approved second time.

snabbu

Established Member

- Joined

- Sep 1, 2014

- Posts

- 1,716

- Qantas

- Platinum

- Oneworld

- Emerald

Agreed. The last few years I've been watching these offers they are mostly within North America.Recently received Marriott Luxury spend $500 get $100 and Marriott spend $250 get $50 back, but terms state only in the US, Canada and a few other locations.

Do people who’ve utilised previous similar offers noticed if the terms have always said US only? I’ve used one such Marriott one before but can’t recall if the terms stated only those locations or worldwide then.

I'm not getting charged a %. It's always a flat fee (if under rolling AUD9000 monthly cap). The challenge I'm having is accessing the AUD4 flat fee — I keep getting charged the AUD8 flat fee.Revolut use a % fee for international transfers.

just wanted to see if anyone has got any experience on this?Question to all US card holders who applied using their passport or ITIN (no SSN), have you ever had issues with your credit cards after using them for a long time in Australia and not much in the US? Like for groceries, dining, bills and etc? like a couple years or more? I'm talking about banks like Chase, CapitalOne, Citi and AmEx or any other if you have a card with like US Bank or BoA.

Have you been asked to go into a branch or been questioned around why you have international spend mostly?

I know someone who has used their CSP exclusively overseas since day one and never had a problem. Never heard of anyone with an AMEX having a problem either. The one note of caution. I do think you need to start slowly with spending to avoid triggering fraud detection blocks when using exclusively overseas.just wanted to see if anyone has got any experience on this?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 398 (members: 11, guests: 387)