Is the us amex surcharge same as Aussie Amex when using sniip?Quick Update:

The dispute Cash Advance Fee went in my favour as a good will jesture. Lesson is not to use Yakpay for Amex US card. SNIIP went as a normal transaction on the US Amex.

Have anyone have used non Amex cards such as chase/Citi/ etc on payment platforms such as Rewards pay, Yakpay etc. Was it treated as cash advance?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

Yes...Is the us amex surcharge same as Aussie Amex when using sniip?

DP:

I applied for a Amex Surpass Hilton Card and was declined. Reason: I had a Amex payment rejected by my Bank (HSBC) in the last 30days.

Background: Citibank US (Primary Bank) had my account locked (now unlocked) for verification for nearly 2 weeks. So I changed my Bank in Amex to HSBC US. However, Due to the pull from Amex taking a bit of time, I was short of funds fr couple of hours on my second pull. Because of that I got fined - $35 (refund - goodwill) and hence my application was rejected. Do note this pull from Amex was done before the Amex statement being generated so that I could have my credit utilisation lowered. No impact with credit file but wrap on the wrist by Amex.

Future: I was advised by a nice CS - to call Amex and provide my debit card details, if there is money in your bank account, the pull will go through at the very moment, if not it will get declined with the CS. You can then give an alternative card.

I applied for a Amex Surpass Hilton Card and was declined. Reason: I had a Amex payment rejected by my Bank (HSBC) in the last 30days.

Background: Citibank US (Primary Bank) had my account locked (now unlocked) for verification for nearly 2 weeks. So I changed my Bank in Amex to HSBC US. However, Due to the pull from Amex taking a bit of time, I was short of funds fr couple of hours on my second pull. Because of that I got fined - $35 (refund - goodwill) and hence my application was rejected. Do note this pull from Amex was done before the Amex statement being generated so that I could have my credit utilisation lowered. No impact with credit file but wrap on the wrist by Amex.

Future: I was advised by a nice CS - to call Amex and provide my debit card details, if there is money in your bank account, the pull will go through at the very moment, if not it will get declined with the CS. You can then give an alternative card.

Able to login and browse without any problemsIs anyone having issues login in or creating an account on US Starbucks app

Last edited:

Several minutes ago I loaded $20 onto the app, paying with the Aspire. All looks good. I use a VPN.Is anyone having issues login in or creating an account on US Starbucks app

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

I just loaded $10 (bonvoy) + $20 (Aspire) without using VPN.

Probably not. I use US paypal account.

Valid only for purchases made in U.S. Dollars using U.S. PayPal accounts. PayPal accounts associated with any non-U.S. country are ineligible.

Can you get Amex platinum card PayPal credit if you add us amex plat to Aussie PayPal account?

Probably not. I use US paypal account.

Page Not Found | American Express US

The page you are looking for cannot be found. Use this page to navigate to the part of the site you are looking for.

www.americanexpress.com

Valid only for purchases made in U.S. Dollars using U.S. PayPal accounts. PayPal accounts associated with any non-U.S. country are ineligible.

jbmemories

Member

- Joined

- Jan 22, 2021

- Posts

- 213

- Qantas

- Platinum 1

- Oneworld

- Emerald

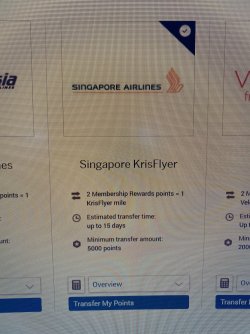

Apparently Singapore Airlines Krisflyer transfer will become 3:2 for the UK Amex version as well:

Amex cutting KrisFlyer transfer rate to 3:2 - will others follow?

Kind of difficult nonetheless for us to travel til late 2021 anyways. Hopefully the other credit cards don't follow suit as well (whether it be Krisflyer or any other transfers)

Edit Note: it's UK - not US sorry!

Amex cutting KrisFlyer transfer rate to 3:2 - will others follow?

Kind of difficult nonetheless for us to travel til late 2021 anyways. Hopefully the other credit cards don't follow suit as well (whether it be Krisflyer or any other transfers)

Edit Note: it's UK - not US sorry!

Last edited:

Thanks for sharing. Seems like the long held 1:1 on MR is breaking. This is AMEX UK but wonder if this will lead to a revision on AU and US MR programs. This would likely set off a broader re-pricing - I'm sure all airline partners would like some financial "relief". I doubt it's only shareholders who will be asked to take a haircut as a result of COVID. I hope I'm wrong.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Apparently Singapore Airlines Krisflyer transfer will become 3:2 for the US Amex version as well:

Amex cutting KrisFlyer transfer rate to 3:2 - will others follow?

Kind of difficult nonetheless for us to travel til late 2021 anyways. Hopefully the other credit cards don't follow suit as well (whether it be Krisflyer or any other transfers)

Bad news for me. There is no point to transfer AU MR to US MR now as I will only get a couple thousand more per 100k. Not worth the trouble.

Edit: Looks like this is for UK, not US?

Last edited:

Bad news for me. There is no point to transfer AU MR to US MR now as I will only get a couple thousand more per 100k. Not worth the trouble.

Edit: Looks like this is for UK, not US?

Headforpoints is a UK focused website, and given the article talks about pounds per point, I would assume that change is for the UK version, not the US version.

That’s great news! Unfortunately my apartment’s owner corp goes through DEFT, so can’t use Sniip and Amex to make payments.Quick Update:

The dispute Cash Advance Fee went in my favour as a good will jesture. Lesson is not to use Yakpay for Amex US card. SNIIP went as a normal transaction on the US Amex.

Have anyone have used non Amex cards such as chase/Citi/ etc on payment platforms such as Rewards pay, Yakpay etc. Was it treated as cash advance?

But the AU MR program hasn’t been 1:1 with airlines for a while now? Hasn’t it been 2:1 since April-19 or so?Thanks for sharing. Seems like the long held 1:1 on MR is breaking. This is AMEX UK but wonder if this will lead to a revision on AU and US MR programs. This would likely set off a broader re-pricing - I'm sure all airline partners would like some financial "relief". I doubt it's only shareholders who will be asked to take a haircut as a result of COVID. I hope I'm wrong.

Or are you suggesting that because UK MR’s program is devaluing the MR there, that we will be seeing another round of devaluations here too? I sure hope not.

yep as effectively, we are 1:1 (the more expensive cards have had this largely neutralised as they earn twice as many points so the effective SQ earn rate is effectively the same as it was pre-deval). This might work out to 6 AU MR for 2 SQ (if my maths is correct). If the UK is a "larger" market than AU - reckon if it flows through to the US, only a matter of time before SQ and other carriers enforce a price rise on Amex AU. I hope I'm wrong.

Wasn’t KrisFlyer still 1:1?But the AU MR program hasn’t been 1:1 with airlines for a while now? Hasn’t it been 2:1 since April-19 or so?

US happens to be the market with the highest merchant fee, and unlike many other markets where Amex is the only game in town.. you have multiple competitors over there. They would only devalue the transfer rate after exhausting every conceivable option.

Ah, are you referring to $1 per mile when you say 1:1? Sorry I thought you meant 1 MR : 1 KF mile. Believe it currently is 2 MR to 1 KF mile for the AU MR program. I hope you’re wrong too! Not sure how I’d feel about another devaluation on my MR stash. :/yep as effectively, we are 1:1 (the more expensive cards have had this largely neutralised as they earn twice as many points so the effective SQ earn rate is effectively the same as it was pre-deval). This might work out to 6 AU MR for 2 SQ (if my maths is correct). If the UK is a "larger" market than AU - reckon if it flows through to the US, only a matter of time before SQ and other carriers enforce a price rise on Amex AU. I hope I'm wrong.

It’s $1 per mile for a number of cards now. But no longer 1 MR to 1 KF which it was before the devaluation. Or effectively earning us more than 1 KF per $ then.Wasn’t KrisFlyer still 1:1?

Edit: photo of current KF transfer rate from my AU Amex account below.

Attachments

Last edited:

We're currently earning effectively 1+ (ie 1.125 on Platinum Charge) for every $1 spent. so while we earn 2.5 MR we're still at 1:1.

To go to the equivalent of 3/2 = 1.5 MR:1 (I think), in our system is 6 AU MR for 2 SQ. Does this make sense? Have I got my maths right?

To go to the equivalent of 3/2 = 1.5 MR:1 (I think), in our system is 6 AU MR for 2 SQ. Does this make sense? Have I got my maths right?

Yeah understood where you were going with the mpd rate. It’s just the article was referring to MR points to KF miles when they mentioned 3:2. So I didn’t realise you were talking about the mpd earn rate.We're currently earning effectively 1+ (ie 1.125 on Platinum Charge) for every $1 spent. so while we earn 2.5 MR we're still at 1:1.

To go to the equivalent of 3/2 = 1.5 MR:1 (I think), in our system is 6 AU MR for 2 SQ. Does this make sense? Have I got my maths right?

You’ve got me, I’m confused haha. If the transfer rate from AU MR to KF is 3:2. Isn’t it simply 1.5 AU MR to 1 KF like you’ve suggested or 3 AU MR to 2 KF miles? Wouldn’t be 6 AU MR to 2 SQ?

Update:Yes identification appeared to be an impossible hurdle for the operator on my first phone call. On the second phone call after some careful explanation on my behalf the operator managed to look up my account with my first and last name and saw that I was waiting on the Surpass card. The issue seemed to be that I hadn't waited the full 10 business days. He said it would be no problem to send it to Australia after that timeframe. This might include needing to do a verification involving Notary Cam but because I was still within 10 days he didn't elaborate on the next steps. Hoping to avoid doing another NC (my third) but if it's the only way to get the card then I'll oblige.

After two more phone calls it appears that my Hilton Surpass card is on its way to my Aus address according to my online Amex account which now shows an updated expected delivery date, my Aus shipping address with DHL and tracking number. The verification process from the first call was different to the second.

I was asked the usual questions to begin with such as providing SSN and account number to which I responded that I applied using my passport through a global transfer etc. When the Amex representative could see my account and its status I was transferred to the card replacement team. I was asked a few validation questions including providing my current us address and phone number. After these general questions, the representative then asked to do an email validation using a sent code. As I was checking my email to provide the code the call disconnected due to bad signal. Awful timing!

On the second attempt I was initially transferred to the security and fraud team. I don't know if this was intentional or an error on the representative's behalf but I explained my situation and he transferred me through to the card replacement team. This time I was asked less validation questions and basically told that I needed to do a notary cam so Amex could identify me and then they would send the card to the Aus address. I was advised I would receive a call from Amex after they received the notary cam document and then the card would be sent. After confirming my Aus address for shipping I asked the Amex representative whether that would automatically change the billing address to the Aus address and he said no that it would still be the US one shown on my account. I completed the notary cam last Thursday and I was about to call Amex yesterday as I had not heard anything but I checked my account and noticed it had been updated with new tracking details. I did not however receive a phone call on either my Aus mobile or my Textnow US number as they had advised.

So for those still considering going down that path in order to receive USPS delivered cards, with a few phone calls and some patience it seems to have worked out and I notice that Sapz and others have also had success recently.

Has anyone successfully changed their account address online to another US address without further verification? After I receive my card I need to change my US address to my new US address which includes the premium +mail subscription. Ideally I'd like to avoid any kind of address verification if possible.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- dcg

- Micbro23

- MooTime

- SYD

- pauldab

- markis10

- Bundy Bear

- ncm

- Platinum4455

- trooper

- meljfk

- Harrison_133

- anat0l

- mouseman99

- AIRwin

- saketreddy

- wentworthmeister

- dajop

- Lat34

- JB001

- downgraded

- MEL_Traveller

- mrsterryn

- Ttwines

- BodohBordeaux

- hydrabyss

- Forg

- fonkyhonkytonk

- hachoo

- lukeaust

- vmile

- makingit

- Viridis

- Dmac59

- Austman

- RooFlyer

- kearvaigskewer

- Brissy1

- MH_fan

- CaptJCool

- zig

- Pete98765432

- chol

- Black Duck

- AussieTim

- daft009

- cgichard

Total: 877 (members: 55, guests: 822)