Ecco

Member

- Joined

- Apr 21, 2018

- Posts

- 178

I've got the Amex Green card. Been very good so far. An adventure finding out what counts as 3x earn...

Just wondering it comes with a $199 Clear Plus (TSA fast track type membership) benefit. Has anyone been able to get clear plus as a non resident of the US? It says when I search chatgpt that it may be possible. I've got a query in with the company but just thought someone here might have been able to do this.

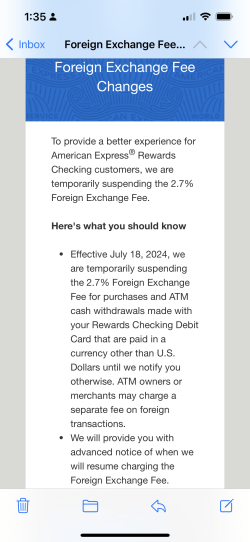

Also has anyone opened an amex savings account. I got an email yesterday offering savings account on call with 4.10% interest income rate.

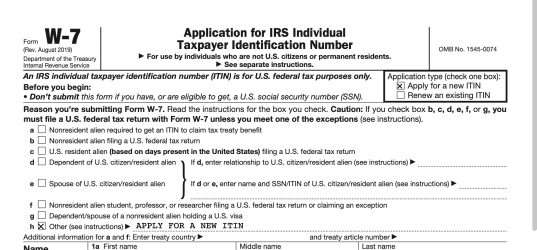

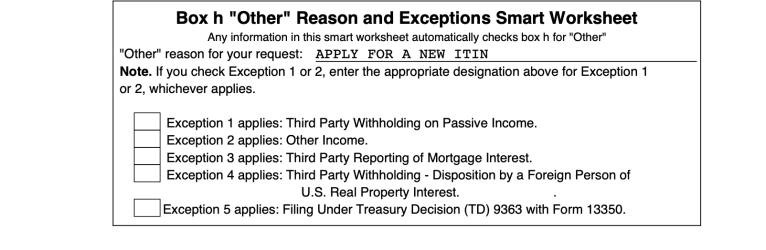

Just wondering do you need ITIN/SSN to open one of these accounts?

Just wondering it comes with a $199 Clear Plus (TSA fast track type membership) benefit. Has anyone been able to get clear plus as a non resident of the US? It says when I search chatgpt that it may be possible. I've got a query in with the company but just thought someone here might have been able to do this.

Also has anyone opened an amex savings account. I got an email yesterday offering savings account on call with 4.10% interest income rate.

Just wondering do you need ITIN/SSN to open one of these accounts?