Hope you didn't put any money into this bet.I am not thinking that there will be any major market movement this week. Any other thoughts?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,301

Would this be a good time to transfer super from hostplus to Australian super ?

Radio8tiv

Member

- Joined

- Jul 13, 2015

- Posts

- 409

Why?Would this be a good time to transfer super from hostplus to Australian super ?

hostplus is relatively cheap and also offer a great mini SMSF program through their choiceplus option, where you can direct invest in the ASX300, ETFs, LICs and term deposits

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,301

Fee wise . Aus super seems to be cheaper . Don’t aus super offer same investment program ?Why?

hostplus is relatively cheap and also offer a great mini SMSF program through their choiceplus option, where you can direct invest in the ASX300, ETFs, LICs and term deposits

lovetravellingoz

Enthusiast

- Joined

- Jul 13, 2006

- Posts

- 12,711

. Don’t aus super offer same investment program ?

Yes. Though if one is better than the other I have no idea.

Build Your Own Super Investment Portfolio | AustralianSuper

Take complete control of your investments with our self-managed Member Direct option. Register today and start choosing your own investment strategy!

Tap into your inner investor and take complete control of your investments with our self-managed Member Direct option.

What is Member Direct?

Member Direct offers you greater control and choice in the investment of your super or retirement income. You can invest in shares, Exchange Traded Funds (ETFs), Listed Investment Companies (LICs), term deposits and cash – all from an easy-to-use online platform.You also get access to real-time trading, extensive market information, independent research and investment tools to help you make informed investment decisions and manage your portfolio. This option suits members who want to be actively involved in managing their investments.

How does it work?

You make your own strategy by investing in your choice of:- shares in the S&P/ASX 300 Index

- Exchange Traded Funds (ETFs)

- Listed Investment Companies (LICs)

- term deposits

You transfer money from your other AustralianSuper investment options into this account, and then use this money to invest. You can also do the reverse and transfer money from this transaction account back into your other AustralianSuper options.

Radio8tiv

Member

- Joined

- Jul 13, 2015

- Posts

- 409

Yes they do, it’s called member direct and costs $395 p.a as an investment option.Fee wise . Aus super seems to be cheaper . Don’t aus super offer same investment program ?

with Hostplus it’s called Choiceplus and costs $180 p.a, there are slight differences in the costs to place a trade with either being cheaper depending on the value of the trade.

Fees wise aus super is $2.25 per week plus up to .04%

hostplus is $1.50 per week plus .02% if you use the balanced indexed investment option.

insurance fees I’m not sure on as I don’t use the option to minimise my fees.

but as always DYOR

CaptJCool

Established Member

- Joined

- May 31, 2012

- Posts

- 4,110

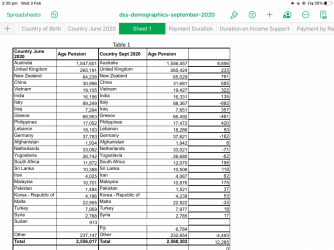

of the approx net 360,000 who have turned 66.... about net 30,000 are on Age pension in Sept 2020 so by June 2021 approx net 45,000 (12.5%) with Census 2021 looming to provide updated population figures...The September 2020 Age Pension figures have shown up....

there is overs and unders in this with the 2016-17 asset test changes moving net 60,000 off so that means 90,000 new recipients....

the background

Aged pension recipients numbers as follows;

Sept 2013 2,359,215

June 2014 2,404,902

June 2015 2,486,195

June 2016 2,538,161

Census total over 65 3,676,763 so 69.5% by Sept 2016

Sept 2016 2,556,410

June 2017 2,498,765

June 2018 2,477,861

June 2019 2,533,359

June 2020 2,556,017

Sept 2020 2,568,302

2021 Census total ESTIMATE

needs include pop aged 60 plus at 2016 census..

4,976,160 (2016 Census pop 60+)

LESS

Deaths (650,000) (5 years by 130,000)

Adjustment for age pension age = 66(290,000)

TOTAL AT 2021 Age Pension Age 4,036,160 (63-66% of senior Australians as at sept 2020) with the full effect of Super 1992-2021 (29 years not yet in the mix)

trend % would be that around 62.5% of all those over 65 at Census 2021 would be Age Pension recipients

DSS Payment Demographics

Search

RB

Established Member

- Joined

- Nov 17, 2004

- Posts

- 4,310

Yep. Then they argue with each other on forums. Some cough about the cost of caravan parks while others trash the free campsConsidering that compulsory superannuation started in 1983 it does look like many retirees are buying a caravan and a 4 wheel drive to tow it to qualify for an age pension.

- Joined

- Jun 20, 2002

- Posts

- 17,757

- Qantas

- Gold

- Virgin

- Platinum

From my recollection, Paul Keating created the legislative framework for defined contribution superannuation in May 1983 (with a start date of 1 July) and changed the taxation of lump sum superannuation from 45% at retirement, to three sets of 15%:Considering that compulsory superannuation started in 1983 it does look like many retirees are buying a caravan and a 4 wheel drive to tow it to qualify for an age pension.

15% of employer or tax deductible contributions upon receipt by fund,

15% of the investment earnings of the super fund [less any taxation benefits like dividend imputation, tax free or tax deferred income] and then

15% of the super fund balance relating to employer or tax deductible contributions at withdrawal (subject to certain conditions). This last part is largely moot with the change to preservation ages (started at 55, now moving up to 60) and the ability to strategically withdraw and recontribute those funds and reduce the tax liability.

Industrial superannuation started in 1987 (so award based workers), whilst compulsory superannuation started in 1993 at 3%. Oh it pains me to remember that, it shows my age...

Last edited:

- Joined

- Jan 26, 2011

- Posts

- 29,510

- Qantas

- Platinum

- Virgin

- Red

Given the share market slumps since, GFC etc and for those of retirement age right now, 3% starting from 1993 hardly creates for comfortable retirement for those who just miss the cut off for the age pension. Of course some are much better off but likely those people were independently wealthy regardless of any super.whilst compulsory superannuation started in 1993 at 3%. Oh it pains me to remember that, it shows my age...

- Joined

- Jan 26, 2011

- Posts

- 29,510

- Qantas

- Platinum

- Virgin

- Red

Just when we were able to put more from our business into our personal Super, when the kids had finished Uni, the Gummit limited how much we could Salary Sacrifice. Timing sucks.Yes 3% climbed steadily and is now 9.5% for compulsory superannuation with employees not required to contribute. That said we have a number of staff who do contribute voluntarily.

sinophile888

Active Member

- Joined

- Mar 17, 2008

- Posts

- 836

Towards the end of my working life, I was contributing the maximum allowed. It certainly improved my superannuation account.Yes 3% climbed steadily and is now 9.5% for compulsory superannuation with employees not required to contribute. That said we have a number of staff who do contribute voluntarily.

- Joined

- Jan 26, 2011

- Posts

- 29,510

- Qantas

- Platinum

- Virgin

- Red

Yes indeed. We are certainly maximizing it now plus put personal contributions in when we sold the home last year.Towards the end of my working life, I was contributing the maximum allowed. It certainly improved my superannuation account.

- Joined

- Jun 20, 2002

- Posts

- 17,757

- Qantas

- Gold

- Virgin

- Platinum

One is a significantly better off with ones own independent income, than relying on Centrelink Age Pension. Every dollar in asset (or income) above the minimum threshold doesn't give a dollar for dollar reduction. The only real and tangible benefits are the Health Care Card and that the Age Pension doesn't have an asset backing it that moves with market volatility. It has the taxpayers of Australia funding it.Given the share market slumps since, GFC etc and for those of retirement age right now, 3% starting from 1993 hardly creates for comfortable retirement for those who just miss the cut off for the age pension. Of course some are much better off but likely those people were independently wealthy regardless of any super.

- Joined

- Jun 20, 2002

- Posts

- 17,757

- Qantas

- Gold

- Virgin

- Platinum

Downsizer contributions or just using the personal contributions cap x 2, or both? Excellent strategiesYes indeed. We are certainly maximizing it now plus put personal contributions in when we sold the home last year.

- Joined

- Jun 20, 2002

- Posts

- 17,757

- Qantas

- Gold

- Virgin

- Platinum

The good news is that it climbs to 10% from 1 July 2021 (and by 0.5% annually until 1 July 2025 when it hits 12%): Key superannuation rates and thresholdsYes 3% climbed steadily and is now 9.5% for compulsory superannuation with employees not required to contribute. That said we have a number of staff who do contribute voluntarily.

There is also the benefit of the unused concessional cap carry forward provisions:

From 1 July 2018 if you have a total superannuation balance of less than $500,000 on 30 June of the previous financial year, you may be entitled to contribute more than the general concessional contributions cap and make additional concessional contributions for any unused amounts.

The first year you will be entitled to carry forward unused amounts is the 2019–20 financial year. Unused amounts are available for a maximum of five years, after which they will expire.

All concessional contribution caps can be found here (along with the unused concessional carry forward): Key superannuation rates and thresholds

Something I just found whilst surfing the ATO website, a page for employers to do a course in SG and get a certificate for successful completion: SG employer obligations course

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- PatMcrotch

- jc123

- kpc

- AndrewL

- ausfox

- DejaBrew

- ripper

- asterix

- love_the_life

- BriarFlyer

- mrsterryn

- satirical

- smsh63

- mouseman99

- Beano

- b3LKMZAYN9

- dcg

- RooFlyer

- rbjhan

- Mqrko

- Daver6

- drmatte

- Larko1

- RB001

- Mohitems

- Flyfrequently

- Learned_One

- pyffii

- flyingfan

- Cottman

- jase05

- offshore171

- Digicola

- Matt Graham

- brissie

- carwashhair

- gaz0303

- Junior royal

- Townsville flyer

- pauly7

- jrfsp

- WeeWillyWonka

- justinbrett

- OZDUCK

- mattr00

- Bundy Bear

- Zinger

- WrenchHammerMcTool

- Austman

- ghinx

Total: 535 (members: 69, guests: 466)