Denali

Senior Member

- Joined

- Sep 17, 2012

- Posts

- 6,057

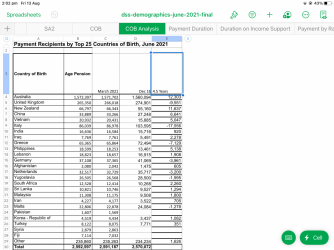

It was in my weekly members email from TAPSWell I’ve got probably another 20-25 years worth of working life ahead of me! Early retirement plans aside…

@Denali - can you share where you got that infographic from. I’d read about the delays but in a dry boring legislative update and would love to send that one on to my HR guys.

Theres a 30 day free trial,