- Forums

- Community Announcements & Discussion

- Archive Forum

- Coronavirus (COVID-19)

- Refunds & Travel Insurance

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Travel Insurance which covers COVID-19?

- Thread starter garybatz

- Start date

-

- Tags

- covid-19 travel insurance

So I have decided to go with Insure and Go for my trip - it's $156.44 for two countries for a fortnight and has the unlimited COVID-19 expenses claim.

Friends of mine who just went to Asia said Allianz was good, but I can't wrap my head around it's language on it's website and I'm not 100% if it covers all I need.

Friends of mine who just went to Asia said Allianz was good, but I can't wrap my head around it's language on it's website and I'm not 100% if it covers all I need.

Thought I'd share my experience that I used my American Express Frequent Flyer Ultimate credit card insurance. I contacted them and explained that I needed proof of coverage for Covid19. They sent me this, and I successfully used this as part of my application for a Thai Pass. I've edited it to remove my name. You should be able to call them and get them to e-mail this to you. Hope this helps.

Attachments

k_sheep

Established Member

- Joined

- Apr 2, 2009

- Posts

- 2,230

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

Tried to get the PDS ... then remembered I dumped avant as my indemnity provider last year tooJust checked the email I got

Does not mention cruise exclusions

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,464

- Qantas

- LT Gold

- Virgin

- Gold

An email from covermore with some guidelines

It may help someone

It may help someone

Melburnian1

Veteran Member

- Joined

- Jun 7, 2013

- Posts

- 26,136

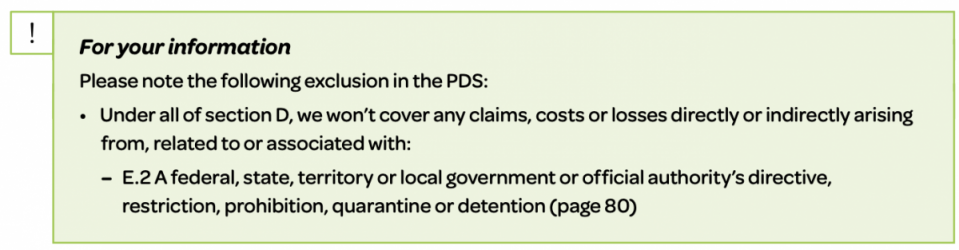

Southern Cross looked great, until I read this.

(the whole point of my insurance is to cover medical costs in a different country AND the excess costs of quarantine).

View attachment 277264

Agree, and also, Southern Cross Travel Insurance excludes coverage for travel to many destinations such as when the Australian Government's Smart Traveller site says 'reconsider your need to travel' (examples include Brazil, Chile, Colombia, Cuba, Ecuador, Guam, Mexico, Philippines, Saudi Arabia, Solomon Islands (!) and Tonga) or 'do not travel' (examples include Iran and Venezuela).

Yet with some nations above, the reason(s) government bureaucrats claim one should 'reconsider' do not focus on COVID_19 at all.

A useless policy, so despite many on review sites recommending this company, it's one to avoid:

Supplementary Product

Disclosure Statement (SPDS)

Effective from 17 November 2021

scti.com.au

In summary, this SPDS extends your policy to cover:

• Medical expenses (up to $Unlimited) if you are diagnosed with COVID-19 while on your journey

• Costs (up to the limit you selected when you purchased your policy) to change your travel

arrangements if you or a relevant person (relevant person conditions apply) are diagnosed

with COVID-19 before you leave and your journey is cancelled or amended

• Costs (up to $5,000) to change your travel arrangements if you or a relevant person

(relevant person conditions apply) are diagnosed with COVID-19 after you leave and your

journey is interrupted or cut short

Cover only applies when travelling to a destination with a Smartraveller travel advice level of

‘Exercise normal safety precautions’ (level 1) or ‘Exercise a high degree of caution’ (level 2).

Too crafty by half.

Melburnian1

Veteran Member

- Joined

- Jun 7, 2013

- Posts

- 26,136

I found the COVID -related info for Go Insurance was clearer than most:

A travel insurance policy that covers COVID-19? - Go Insurance

These policy updates mean you may be covered if you or your travelling companion contract COVID or are specifically quarantined due to exposure to COVID. Nowww.goinsurance.com.au

Seems a good policy but for multi-trip annual, it excludes longer than 60 days.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Seems a good policy but for multi-trip annual, it excludes longer than 60 days.

I found multi trip didn't become economic until you had done 3 trips including the USA/Africa or 4-5 trips excluding USA/Africa; so I have 3 separate policies for 3 trips as was cheaper as only one of those trips needed USA cover.

I like that Go Insurance still covers countries with a Level 3 "Reconsider your need to travel" if the sole reason is "due to the impacts of COVID-19". Obviously any warning due to war/terrorism still excluded if the warning is reconsider or do not travel.

I will be going to the UK, Germany and Switzerland for 3 weeks from mid Sept and like may others, am trying to get my head around the intricacies of travel insurance.

From my reading of this thread I have a short list of 3 - Medibank, Insure and go, Go insurance. And now I have more reading of PDS's and so on. As I am 70 and travelling alone I am happy to pay a slightly higher premium for maximimum coverage and minimum angst.

I am yet to make a decision but even at this stage I would like to thank the large number of contributors who have shared their experiences and knowledge. Your input is very much appreciated

Cheers

From my reading of this thread I have a short list of 3 - Medibank, Insure and go, Go insurance. And now I have more reading of PDS's and so on. As I am 70 and travelling alone I am happy to pay a slightly higher premium for maximimum coverage and minimum angst.

I am yet to make a decision but even at this stage I would like to thank the large number of contributors who have shared their experiences and knowledge. Your input is very much appreciated

Cheers

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

Has anyone found a policy for 80yo please? For a couple, one is a cancer survivor and therefore has pre-existing.

Last edited:

- Joined

- Apr 6, 2018

- Posts

- 2,885

Have no detail but just saw an ad on Channel 7 spruiked by an 85 yo allegedly covering CovidHas anyone found a policy for 80yo please? For a couple, one is a cancer survivor and therefore has pre-existing.

Started w C but it wasnt CoverMore

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

Maybe CGU?

Have no detail but just saw an ad on Channel 7 spruiked by an 85 yo allegedly covering Covid

Started w C but it wasnt CoverMore

- Joined

- Apr 6, 2018

- Posts

- 2,885

Travel | COTA Insurance

COTA Travel Insurance - our range of plans means you can choose the level of cover you need to suit the trip you're taking.

this was it

never heard of it

- Joined

- Jan 26, 2011

- Posts

- 30,145

- Qantas

- Platinum

- Virgin

- Red

That’s Council of the Ageing so likely an excellent option

Travel | COTA Insurance

COTA Travel Insurance - our range of plans means you can choose the level of cover you need to suit the trip you're taking.www.cota.com.au

this was it

never heard of it

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

Thanks yes, COTA. They did tell me it was very expensive. I suspect that it is going to be very exy whomever they find to get TI from.

Travel | COTA Insurance

COTA Travel Insurance - our range of plans means you can choose the level of cover you need to suit the trip you're taking.www.cota.com.au

this was it

never heard of it

Last edited:

- Joined

- Apr 6, 2018

- Posts

- 2,885

Could try RACV - have excellent products although with the traveller profile you mention I fear it willbe$$$Thanks yes, COTA. The did tell me it was very expensive. I suspect that it is going to be very exy whomever they find to get TI from.

Best of luck to them

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

Melburnian1

Veteran Member

- Joined

- Jun 7, 2013

- Posts

- 26,136

I found multi trip didn't become economic until you had done 3 trips including the USA/Africa or 4-5 trips excluding USA/Africa; so I have 3 separate policies for 3 trips as was cheaper as only one of those trips needed USA cover.

I like that Go Insurance still covers countries with a Level 3 "Reconsider your need to travel" if the sole reason is "due to the impacts of COVID-19". Obviously any warning due to war/terrorism still excluded if the warning is reconsider or do not travel.

Great, but since we are not travelling to USA/Africa, GO travel insurance's quote (maximum length of trip 60 days, excess $100 per claim) was $1445.41 for a single 60 day trip for two 'Go Plus' (probably half that for one traveller), but only marginally more for its 'Go Plus' (higher levels of cover than basic) annual multi trip policy at A$1531.00. The only rider is that with the latter, excess rises to A$200 per claim.

I checked COTA but for a single trip for two persons using above criteria it was $1656. Nonetheless it may be handy for older ladies and gents.

Danger

Suspended

- Joined

- Jun 19, 2006

- Posts

- 7,819

I recently returned from a 45,000+ mile overseas jaunt and took the ANZ credit card insurance, underwritten by Allianz, with me.

I had two issues while I was away. First, Iberia failed to deliver one of my 2 bags. (As an aside, I believe I've flown IB 12 times (at most) in my life and the airline has managed to lose my bags twice.) I was without the suitcase for about 52 hours. Because of the delay I had about AUD300 in expenses. Second, I fell ill in the US with what I thought was likely covid but a PCR test said no. I saw a doctor (which itself is an experience ("Your package includes a strep test but you'll need to upgrade for another $130 if you want the PCR test"). As a result of falling ill, I had medical expenses and had to can a flight and rebook, totalling about AUD800.

After returning to Australia, I spent about 75 minutes completing the claim on the Allianz portal. The claim was approved in less than 45 minutes - on a public holiday! The amount I'm apparently going to receive is what I thought it would be.

So while I didn't have to claim against covid, full points to Allianz for looking after me and in an extraordinarily quick timeframe.

I had two issues while I was away. First, Iberia failed to deliver one of my 2 bags. (As an aside, I believe I've flown IB 12 times (at most) in my life and the airline has managed to lose my bags twice.) I was without the suitcase for about 52 hours. Because of the delay I had about AUD300 in expenses. Second, I fell ill in the US with what I thought was likely covid but a PCR test said no. I saw a doctor (which itself is an experience ("Your package includes a strep test but you'll need to upgrade for another $130 if you want the PCR test"). As a result of falling ill, I had medical expenses and had to can a flight and rebook, totalling about AUD800.

After returning to Australia, I spent about 75 minutes completing the claim on the Allianz portal. The claim was approved in less than 45 minutes - on a public holiday! The amount I'm apparently going to receive is what I thought it would be.

So while I didn't have to claim against covid, full points to Allianz for looking after me and in an extraordinarily quick timeframe.

- Joined

- Aug 21, 2011

- Posts

- 16,688

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

I recently returned from a 45,000+ mile overseas jaunt and took the ANZ credit card insurance, underwritten by Allianz, with me.

I had two issues while I was away. First, Iberia failed to deliver one of my 2 bags. (As an aside, I believe I've flown IB 12 times (at most) in my life and the airline has managed to lose my bags twice.) I was without the suitcase for about 52 hours. Because of the delay I had about AUD300 in expenses. Second, I fell ill in the US with what I thought was likely covid but a PCR test said no. I saw a doctor (which itself is an experience ("Your package includes a strep test but you'll need to upgrade for another $130 if you want the PCR test"). As a result of falling ill, I had medical expenses and had to can a flight and rebook, totalling about AUD800.

After returning to Australia, I spent about 75 minutes completing the claim on the Allianz portal. The claim was approved in less than 45 minutes - on a public holiday! The amount I'm apparently going to receive is what I thought it would be.

So while I didn't have to claim against covid, full points to Allianz for looking after me and in an extraordinarily quick timeframe.

Thanks for sharing. I've spent a lot of time reading PDS documents but it's good to hear about real world experiences.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 596 (members: 6, guests: 590)