Are you aware of something which hasn’t been announced on the ASX?

As at 31st December 2018, they had over $1.2 billion in cash or cash equivalent AND reports their assets cover all their liabilities (plus extra):

https://www.asx.com.au/asxpdf/20190213/pdf/442kt5555fq863.pdf

They have refinanced some notes, which is pretty standard to do:

https://www.asx.com.au/asxpdf/20190226/pdf/442zrbgsz5mrff.pdf

I’m far from a finance expert however life experiences have taught me that the headline profit and loss announcements tend to be somewhat misleading.

If a company is cash positive (It’s outgoings is less than it’s incomings) is definitely what needs to be understood as a key factor along with many a belief “cash is king”.

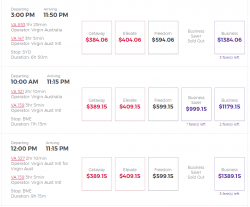

Don’t get me wrong there are genuine issues affecting Virgin and other airlines, the cost of fuel is rising (the majority is probably hedged) and the AUD to USD (in which a lot of payments are made for airlines for fuel and aircraft leasing) exchange rate is dropping. A 1cent drop in the Exchange Rate could be $10,000’s AUD more. Also airfares are still cheap.

(As one, very simple example)If Virgin the accounting department and auditors agree that a B737 aircraft was worth $1million last year, but due to the declining aircraft 2nd hand market it’s now worth $0.5 million, but that’s not one but ten aircraft that’s a $50 million wiped off the profit BUT the reality is the aircraft aren’t actually sold. The company hasn’t lost $50 million its just adjusted the value of its assets. Next year the market conditions have improved as one aircraft is now $1milion .... Wow headline ASX announcement of profits.....

Rule of thumb, read the P&L as part of the accounts and then read the ASX release. (It’s possible that companies have a massive headline profit, but are asset rich and cash poor, the assets and products are worth nothing until sold.)

If a company says it has made a $100 million profit, if you look at the previous corresponding P&L’s the company’s assets (cash) may not have increased by $100 million and it’s possible the assets are worth less.