Bindibuys

Established Member

- Joined

- Jul 5, 2011

- Posts

- 1,829

- Qantas

- Platinum

- Virgin

- Gold

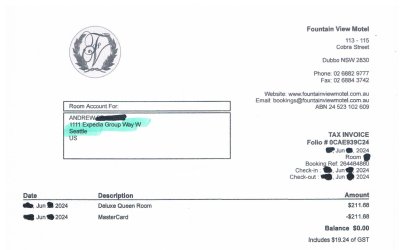

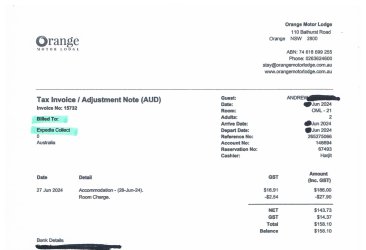

I was just informed by Qantas Hotels that they are no longer supplying a Tax Invoice when you make a hotel booking with them.

If you require a Tax Invoice, you are to ask for it at the hotel, as they are the ones quote - "supplying the service"

I book about 8 hotels per month for my husband for his work travels. I have been chasing a copy of his 3 hotels for this week, and after calling again to get a copy, was informed of this new procedure.

It will be interesting to see if the hotels provide the tax invoice showing the exact amount that I have paid Qantas, now to make some phone calls.....

Email from Qantas Hotels:

Thank you for your recent booking with us, and we appreciate your interest in securing a Tax Invoice for booking reference QA.........

Once your booking is confirmed with us, your payment is sent directly to the property.

Should you require any documentation or breakdown of any taxes applicable to your stay, please contact and make your request directly to the property.

Should you require further assistance, please do not hesitate to reply to this email.

Regards,

Julie

Customer Service Consultant

If you require a Tax Invoice, you are to ask for it at the hotel, as they are the ones quote - "supplying the service"

I book about 8 hotels per month for my husband for his work travels. I have been chasing a copy of his 3 hotels for this week, and after calling again to get a copy, was informed of this new procedure.

It will be interesting to see if the hotels provide the tax invoice showing the exact amount that I have paid Qantas, now to make some phone calls.....

Email from Qantas Hotels:

Thank you for your recent booking with us, and we appreciate your interest in securing a Tax Invoice for booking reference QA.........

Once your booking is confirmed with us, your payment is sent directly to the property.

Should you require any documentation or breakdown of any taxes applicable to your stay, please contact and make your request directly to the property.

Should you require further assistance, please do not hesitate to reply to this email.

Regards,

Julie

Customer Service Consultant