nightelves

Active Member

- Joined

- Jan 11, 2016

- Posts

- 956

Just wanted to check if you do get approval for an Amex card how do you go about paying the credit card bill?

Last edited:

Couple of options:Just wanted to check if you do get approval for an Amex card how do you go about paying the credit card bill?

Just received an email from transferwise saying the US bank details have been changed and it looks like the new US bank account from transferwise is a real bank account that allow direct debits, anyone wants to give it a shot? That would solve the problem of trying to setup a US bank account from Australia.

nightelves, TransferWise is now called Wise. And, you can set up autopay, if you wish, in your US Amex account when you have the card.Just wanted to check if you do get approval for an Amex card how do you go about paying the credit card bill?

Daniel is familiar with AU & USA taxes, bear in mind, you will have to file taxes every year if you obtain a ITIN.

Thanks mate, I will pass the information. Just out of curiosity, what is the normal time to get ITIN, and how much worse it is right now?

Does anyone know how long after you add the SSN/ITIN to your Amex accounts, it filters through to Experian and the likes? Is contacting Experian directly an option and does this hasten the process?

You have received the ITIN already? That was very quick. Did you use one of the agents, recommended upt

I have an SSN, I applied for the Amex Green (P) then Amex Marriott Biz, then Hyatt, then Amex Plat Biz and Cap1 Venture.Some news to share when it comes to SSN and credit scores. This may be obvious to everyone, but I just found out that having a business USA Amex card doesn't contribute to your personal credit reporting - even if you are the primary card holder on the USA business card.

Might need to apply for a personal card then to build up my credit score - as I'll likely need to get subsequent business cards in the USA (and they'll will always ask for SSN on application).

How much did it cost you to setup EIN and S-Corp? Whats the tax implication i.e. DO you have file your tax annually and declare your personal income?it’ll be over 6 months. Pre covid… think I got a EIN no in less than a week. Setting up C or S Corp is still pretty quick these days.

EIN & S-Corp was done like in a week with Daniel Hagen can't remember the costs. Yes also use Daniel to do taxes yearly.How much did it cost you to setup EIN and S-Corp? Whats the tax implication i.e. DO you have file your tax annually and declare your personal income?

I've tried Transferwise and Citibank, and both methods are working. I also got Revolut account. However, it's not working for me. I tried to transfer to the AMEX account in Chase bank, but it never shows up there. After 2 to 3 weeks, the money went back to my revolut account. Am I doing anything wrong with Revolut?Couple of options:

1. Will.com (formerly Transferwise)

2. CitiBank and Revolut.com

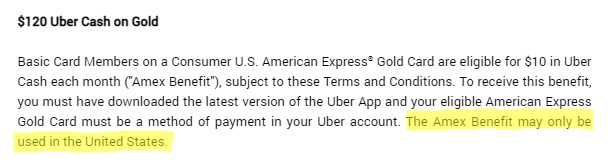

The credit is issued to me every month but I can’t use it probably because the delivery address is not a US add . I’m interested to know as welHas anyone managed to use the Uber monthly credit along with the Uber Eats pass from various US Amex cards in Australia? I've created a new Uber US account and linked my Amex cards to it. However, the monthly credit is not showing up. Maybe because of my GPS showing I am outside the US?

You should be able to get the monthly $10 credit to load into your Uber account however it won't be much use as you can only redeem the value via US Uber purchases.Has anyone managed to use the Uber monthly credit along with the Uber Eats pass from various US Amex cards in Australia? I've created a new Uber US account and linked my Amex cards to it. However, the monthly credit is not showing up. Maybe because of my GPS showing I am outside the US?

Yes correct, the offer is only valid to redeem in US.The credit is issued to me every month but I can’t use it probably because the delivery address is not a US add . I’m interested to know as wel

Buy an american friend a sandwich.You should be able to get the monthly $10 credit to load into your Uber account however it won't be much use as you can only redeem the value via US Uber purchases.

Yes correct, the offer is only valid to redeem in US.

View attachment 257863