You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The totally off-topic thread

- Thread starter QF WP

- Start date

- Status

- Not open for further replies.

- Joined

- Jun 7, 2006

- Posts

- 11,515

- Qantas

- LT Gold

I think I offended a lot of people this weekend, but I had a fun time.

Ah well, we can't be politically correct all the time can we?

Did you drink most of the wine again

penegal

Senior Member

- Joined

- May 17, 2009

- Posts

- 5,753

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

- Star Alliance

- Gold

Did you drink most of the wine again.

haha, there was plenty to go round

I think it was more what I said... Some people struggle with my humor.

JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,199

At least you're not like me.... Most people struggle with my humour.... but that doesn't matter as there is one person that thinks I am funny and that's all that matters.haha, there was plenty to go round

I think it was more what I said... Some people struggle with my humor.

Just been cleaning out drawers in the study and came across a fountain pen I used to use at work (I'm past 60). Has there ever been a way to fill a fountain pen WITHOUT getting ink on yourself? Got it on every single finger!! It's taken me right back to being ink monitor in grade 2 and getting into trouble for being messy

coriander

Established Member

- Joined

- Sep 13, 2014

- Posts

- 1,812

- Qantas

- Gold

- Virgin

- Red

Just been cleaning out drawers in the study and came across a fountain pen I used to use at work (I'm past 60). Has there ever been a way to fill a fountain pen WITHOUT getting ink on yourself? Got it on every single finger!! It's taken me right back to being ink monitor in grade 2 and getting into trouble for being messy

I used to use a 1ml syringe and 18G needle to refill the cartridge on my Parker 75. Or is yours the pen with the lever to refill the ink bladder?

- Joined

- Jan 29, 2012

- Posts

- 15,772

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Emerald

I have forwarded a message to support on your behalf.Has anyone had trouble getting in touch with the people at the AFF Store? I emailed the store through the web form a week ago and haven't heard anything back. I have a warranty claim to make.

- Joined

- Jun 18, 2002

- Posts

- 1,505

- Qantas

- Bronze

- Virgin

- Red

Not sure what happened there. Please send me a PM with the details and I'll follow up.

Has anyone had trouble getting in touch with the people at the AFF Store? I emailed the store through the web form a week ago and haven't heard anything back. I have a warranty claim to make.

Australia's highest-earning Velocity Frequent Flyer credit card: Offer expires: 30 Apr 2025

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

AFF Supporters can remove this and all advertisements

Now the crosshairs are focusing on BMW BMW denies rigging diesel emissions tests after an independent test claims one of its cars blew 11 times over the limit

That was one of the other two brands the guy who uncovered the VW deception tested and found that claims and reality were different from in lab to on-road.

Has anyone had trouble getting in touch with the people at the AFF Store? I emailed the store through the web form a week ago and haven't heard anything back. I have a warranty claim to make.

I misread it the first time and read it as QFF - and was all ready to add "Haven't you answered your own question."

But as it was AFF I know you hadn't from my own experience. I suspect the 'over the page' syndrome came into play.

esseeeayeenn

Established Member

- Joined

- Jul 2, 2014

- Posts

- 2,834

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

Just needed somewhere to post a "LOL" at something else.

I'm done.

I'm done.

Came across this interesting (to me) item about international flight loadings from Jan 1, 2015 to June 30.

Qantas’s Asianisation thrust | Aspire Aviation

Nearly 94% seating sold by Q for the top flight but not that great a revenue earner at 206 flights or 56,000 passengers. Cathay Pacific (74 weekly flights to HK from Aust) carried 886,000 passengers by comparison.

Shock to me was the BA figure!

Qantas’s Asianisation thrust | Aspire Aviation

Nearly 94% seating sold by Q for the top flight but not that great a revenue earner at 206 flights or 56,000 passengers. Cathay Pacific (74 weekly flights to HK from Aust) carried 886,000 passengers by comparison.

Shock to me was the BA figure!

Cruiser Elite

Enthusiast

- Joined

- Oct 31, 2010

- Posts

- 14,026

One of our longstanding good customers fell foul of the local constabulary last Saturday night - lovely bloke but lets just say a sandwich short of a full picnic.

Apparently neighbours complained of noise and he had a visit by 'Plod' at 3am Sunday morn whilst he was ................ using his angle grinder ................. in his bed .................. under his blankets!

Totally unreasonable neighbours wouldn't you say?

Apparently neighbours complained of noise and he had a visit by 'Plod' at 3am Sunday morn whilst he was ................ using his angle grinder ................. in his bed .................. under his blankets!

Totally unreasonable neighbours wouldn't you say?

Last edited:

One of our longstanding good customers fell foul of the local constabulary last Saturday night - lovely bloke but lets just say a sandwich short of a full picnic.

Apparently neighbours complained of noise and he had a visit by 'Plod' at 3am Sunday morn whilst he was ................ using his angle grinder ................. in his bed .................. under his blankets!

Totally unreasonable neighbours wouldn't you say?

But what was the noise they were complaining about?

- Sound of angle grinder on metal

- Screams of pain

- Screams of...?

Suggestion for AFF admin et al:

Now that my posts have reached a emblematic number, can I institute a "-" follow it and a new count.....

787- seems a good number to have...

%*^(%**^$*( I ruined it and posted elsewhere!

Counseling sessions being booked shortly, sniff, sniff

Now that my posts have reached a emblematic number, can I institute a "-" follow it and a new count.....

787- seems a good number to have...

%*^(%**^$*( I ruined it and posted elsewhere!

Counseling sessions being booked shortly, sniff, sniff

Last edited:

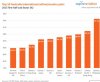

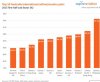

Not attempting to hijack the thread (honestly) but this piece is worth a read. One point that the author missed is that the index has this neat trick that eludes all investors and fund managers - it can decide to drop a company from the index even if the company's shares have been put on a trading halt etc.

So for example, a company that goes into a trading halt and announced that it had purchased a large UK xx_X firm that had apparently falsified its accounting records - subsequently falls 40% before you get a chance to sell it - means you can never match the 'survivorship' bias inherent in any and all indicies.

You can outperform through great stocking picking coupled with good timing (note a great stock does not necessarily make a great investment)!

The author admits choosing a convenient starting point - but then again every other graph is chosen with a convenient starting point. The difference is that this one was chosen to protect the innocent not earn commissions, give margin loans etc.

But the report in yesterday’s Age suggests that while cash can outperform in the short-term, when markets are volatile, over the longer term, stocks win:

But here’s the thing, what if you are a ‘forced seller’ because you’re drawing down on your investments in order to live in retirement?

Or, what if companies aren’t able to maintain those dividend levels? That’s the one thing most mainstream folks seem to forget. The dividend yield on a stock isn’t fixed. If the economy slows, revenue slows, and profits shrink, what will that mean for the dividend?

That’s right, companies will cut dividends. That’s where investors are hit with a double-whammy. Not only will they see their income fall, but the stock price would likely fall too.

And as for the idea that cash can’t outperform stocks over the long term, well, we’ll admit to getting a surprise when we saw the chart we’ll show you now…

The following chart is of the S&P/ASX Accumulation 200 Index (blue line). It represents the Aussie market’s biggest stocks. However, unlike most stock indices, this index calculates the reinvestment of dividends.

In other words, this chart doesn’t just take into account capital growth, it assumes the investor has reinvested all their dividends back into the market.

The orange line represents the S&P/ASX 200 index.

Here’s the chart:

Source: Bloomberg [TABLE="align: center"]

[TR]

[TD][/TD]

[/TR]

[TR]

[/TR]

[TR]

[TD][/TD]

[/TR]

[/TABLE]

The chart runs from the market peak in 2007 through to today. As you can see, without reinvested dividends, the market still hasn’t gone past the 2007 peak.

But with dividends, it has. Case closed, right?

Not so fast. Since the peak, the Aussie market is still down 25%. But here’s the big news. In the eight years since stocks peaked in 2007, the Aussie market with reinvested dividends is only up 7.3%.

That’s a return of less than 1% per year (before tax) over the past eight years.

Sure, we’ve cherry-picked the starting point. Go forward or backward from that starting point and you’ll get a different result to varying degrees.

The point is, by anyone’s measure, eight years is a reasonably long time. It’s certainly long enough for someone to transition from ‘planning for retirement’ to being ‘in retirement’.

There’s no doubt that plenty of folks would have been in that transition period from 2004 through to today. What does this mean for their retirement plans?

Based on the performance of the Accumulation index, so far, those retirees may have been better to get out of stocks and put all their money in cash. At least cash would likely have given them an average return of 4–5% over the past eight years…as opposed to less than 1% for reinvested dividends.

And remember, if things get worse for the Aussie and world economy, there’s no guarantee that companies will be able to maintain those dividend payouts.

And finally this article - how the so-called experts can get it SOOOOOO wrong:

Glencore could be the resource sector's Lehman Brothers - ABC News (Australian Broadcasting Corporation)

The casino continues. Good luck!

So for example, a company that goes into a trading halt and announced that it had purchased a large UK xx_X firm that had apparently falsified its accounting records - subsequently falls 40% before you get a chance to sell it - means you can never match the 'survivorship' bias inherent in any and all indicies.

You can outperform through great stocking picking coupled with good timing (note a great stock does not necessarily make a great investment)!

The author admits choosing a convenient starting point - but then again every other graph is chosen with a convenient starting point. The difference is that this one was chosen to protect the innocent not earn commissions, give margin loans etc.

But the report in yesterday’s Age suggests that while cash can outperform in the short-term, when markets are volatile, over the longer term, stocks win:

‘“What is unusual is how low the return from cash is, relative to dividend yields,” said Catherine Robson, who is the principal at wealth manager Affinity Private. “If you are not a forced seller of equities and can withstand short-term volatility, the dividend yield from the Australian market is still higher than the return from cash.”’

That may be true. Dividend yields are around 5–6%. Cash deposit rates are around 3%.

But here’s the thing, what if you are a ‘forced seller’ because you’re drawing down on your investments in order to live in retirement?

Or, what if companies aren’t able to maintain those dividend levels? That’s the one thing most mainstream folks seem to forget. The dividend yield on a stock isn’t fixed. If the economy slows, revenue slows, and profits shrink, what will that mean for the dividend?

That’s right, companies will cut dividends. That’s where investors are hit with a double-whammy. Not only will they see their income fall, but the stock price would likely fall too.

And as for the idea that cash can’t outperform stocks over the long term, well, we’ll admit to getting a surprise when we saw the chart we’ll show you now…

Is cash really better than dividends?

In other words, this chart doesn’t just take into account capital growth, it assumes the investor has reinvested all their dividends back into the market.

The orange line represents the S&P/ASX 200 index.

Here’s the chart:

Source: Bloomberg [TABLE="align: center"]

[TR]

[TD][/TD]

[/TR]

[TR]

[/TR]

[TR]

[TD][/TD]

[/TR]

[/TABLE]

The chart runs from the market peak in 2007 through to today. As you can see, without reinvested dividends, the market still hasn’t gone past the 2007 peak.

But with dividends, it has. Case closed, right?

Not so fast. Since the peak, the Aussie market is still down 25%. But here’s the big news. In the eight years since stocks peaked in 2007, the Aussie market with reinvested dividends is only up 7.3%.

That’s a return of less than 1% per year (before tax) over the past eight years.

Sure, we’ve cherry-picked the starting point. Go forward or backward from that starting point and you’ll get a different result to varying degrees.

The point is, by anyone’s measure, eight years is a reasonably long time. It’s certainly long enough for someone to transition from ‘planning for retirement’ to being ‘in retirement’.

There’s no doubt that plenty of folks would have been in that transition period from 2004 through to today. What does this mean for their retirement plans?

Based on the performance of the Accumulation index, so far, those retirees may have been better to get out of stocks and put all their money in cash. At least cash would likely have given them an average return of 4–5% over the past eight years…as opposed to less than 1% for reinvested dividends.

And remember, if things get worse for the Aussie and world economy, there’s no guarantee that companies will be able to maintain those dividend payouts.

And finally this article - how the so-called experts can get it SOOOOOO wrong:

Glencore could be the resource sector's Lehman Brothers - ABC News (Australian Broadcasting Corporation)

The casino continues. Good luck!

Buzzard

Senior Member

- Joined

- Jan 22, 2013

- Posts

- 6,900

One of our longstanding good customers fell foul of the local constabulary last Saturday night - lovely bloke but lets just say a sandwich short of a full picnic.

Apparently neighbours complained of noise and he had a visit by 'Plod' at 3am Sunday morn whilst he was ................ using his angle grinder ................. in his bed .................. under his blankets!

Totally unreasonable neighbours wouldn't you say?

Sounds like some B&D gone wrong and I'm not talking Roll A Door

No, no cartridge (my Scottish heritage means I did the maths and the good old bottle of ink outdoes the cartridge by a mile) It's a Waterman pen, you twist the top of the syringey thingy to fill the reservoir. By the way it's 2 days now and I still have inky fingers!I used to use a 1ml syringe and 18G needle to refill the cartridge on my Parker 75. Or is yours the pen with the lever to refill the ink bladder?

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Townsville flyer

- clifford

- Happy Trails

- jrfsp

- There'sOnlyOneJimmy

- Virgin Bart

- SYD

- chrisbris

- MickC32

- Happy Dude

- Steady

- hill

- NoName

- Himeno

- ADLhighflyer

- Wingco

- Maisy33

- markis10

- Mr H

- dairyfloss

- RSD

- Traveller X

- drron

- Junior royal

- Austman

- Duncansaffron

- Harrison_133

- Black Duck

- cgichard

- kelvedon

- Tangenyahu

- Big John

- kpro

- madrooster

- tjb

- Skyhawk

- Jhcaldwe

- MEL_Traveller

- SydneySwan

- TheRealTMA

- Bindibuys

- jase05

- Pete98765432

- PatMcrotch

- joelby

- Peanutbladder

- Rugby

- Solid

- ksthommo

- james4321

Total: 1,114 (members: 70, guests: 1,044)