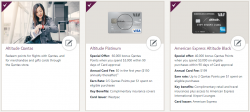

From looking at this:

Altitude Platinum | Westpac

There seems to be no mention of any 18-month waiting period, or any other eligibility conditions for existing cardholders on the Amex side?

Interesting. I can't find the 18 month clause here. I have an active Amex card but do not have Altitude in my name. Might give them a call to see. Get the points, transfer, get out.

What I also realised when signing up, you could get the Platinum Altitude Visa and mix it up with the Black Amex? Considering the Black Visa has a $15000 minimum limit, choosing the Platinum Visa for $6000 and both Amex has a limit of only $3000. Probably an option who want to keep their ccard debt limits low for future loans.

Having an upgraded black amex for the amex lounge and more point value can be an option for some.

Last edited: